8003856854

Payday Loan Debt Settlement – Get Real Help Now And Save

Payday loans (pdls) or cash advance can help you and destroy you at the same time. They give you instant financial relief when some emergency expenses crop up in your life. On the other hand, the exorbitant interest rates drain your savings and destroy your financial life.

In most cases, cash advance push consumers toward massive financial problems owing to high APR and finance charge. After all, paying 500% APR is not a joke. Plus, one has to pay off the entire loan with his next paycheck, which is often not possible.

So, what’s the solution?

One solution is payday loan consolidation and the other one is payday loan settlement. We have already discussed payday loan consolidation here. So, today we will talk about the other solution, which is payday loan settlement.

What is payday loan debt settlement?

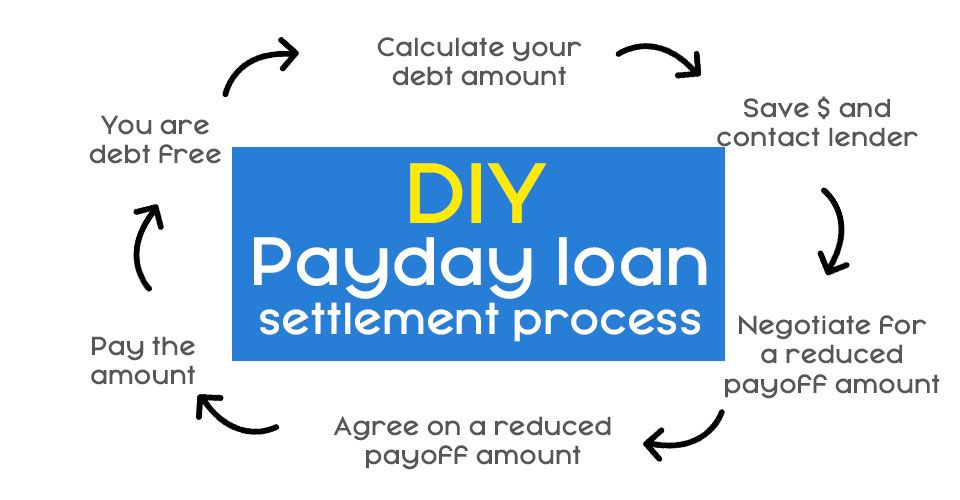

This is one of the many options to reduce payday loan debt through vigorous negotiations with the lenders. You can do the negotiation either by yourself or you can sign up for a company that will do it on your behalf.

In simple terms,

Payday loan settlement (also known as payday loan negotiation) is an approach to debt reduction where you and the lender agree on a reduced payoff amount, which will be considered as payment in full.

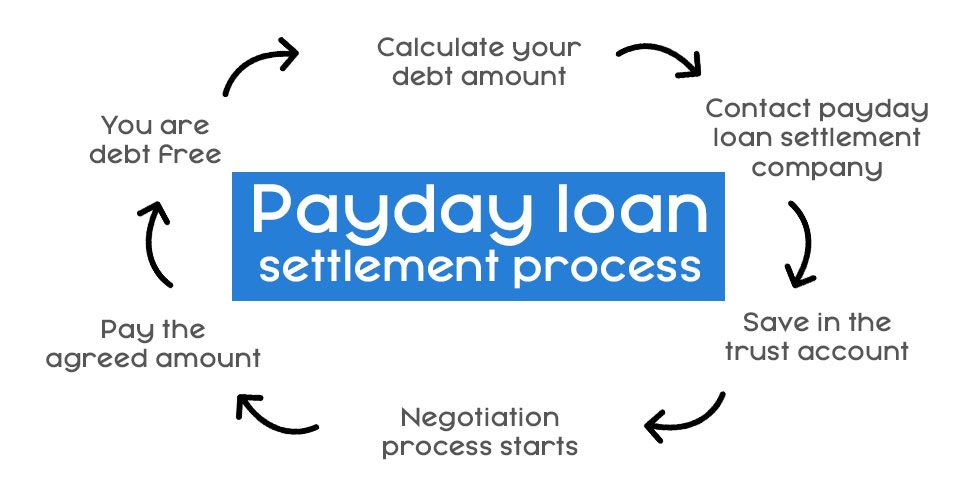

How does payday loan settlement work?

It depends on the kind of approach you adopt. When you enroll in a settlement program, it works in a certain way. Again, when you settle your pdls yourself, the process is slightly different. Let’s find out how.

Otherwise, lenders may not agree to settle payday loans. Here’s how you can revoke ACH authorization.

When should you consider payday loan settlement?

Ideally, you should consider settling payday loans under the following situations:

- 1 When you want to reduce your payoff amount

- 2 When you want to get rid of ACH debits

- 3 When you want to be in control of your overall finances

- 4 When you don’t want to handle debt collection calls

- 5 When you want to save money and get out of debt

Payday loan debt settlement – How to get real help

With this program, you’ll be out of debt quickly, as long as you choose a good company because they can offer you real pdl help. When you settle payday loans yourself, you have no one to guide you. You have no idea about the payday loan industry or state laws or negotiation tactics. But good payday loan debt settlement companies have all the information, and that is why it’s so important to know about the characteristics of a trustworthy company.

Characteristics of good payday loan settlement companies

- 1 Don’t charge upfront fees or advance fees

- 2 Follow all the FTC guidelines

- 3 Create a dedicated account for the consumer in an FDIC insured bank

- 4 Have positive client reviews

- 5 Have an affordable fee structure

- 6 Know all the state payday loan laws

- 7 Have good success rates

- 8 Have an IAPDA certification

What are the pros and cons of payday loan settlement?

| Pros | Cons |

|---|---|

| You have to pay a reduced amount. | You can get scammed if you’re not careful. |

| You can avoid paying late fees and finance charges. | You have to act according to the settlement company’s advice. |

| You can save money. | |

| It comes without an upfront fee. | |

| Collection calls will be less. | |

| You can get rid of debt fast. | |

| It reduces emotional stress. |

What is the best payday loan settlement offer?

- The payoff amount is 50% less than the original amount.

- You’re not required to pay additional finance charges.

- The lender is ready to update your credit report as ‘paid in full’ or ‘paid as agreed.’

When should you reject a payday loan settlement offer?

- When there is no written settlement agreement letter

- When the lender doesn’t follow the state laws

- When the settlement company doesn’t follow the FTC laws

- When the debt is not valid

- When you can’t afford the new payoff amount

How does this payday relief option affect credit score?

There might be a slight dent in your credit score since you’re not paying the full amount. But honestly speaking, the credit score shouldn’t be your concern when you’re in payday loan debt because the high APR can exhaust your savings within a few months. Soon, you may need another payday loan to cover your living expenses and repay your old pdls.

Once you settle payday loans, you can think about rebuilding credit score.